SMEs must be protected from heavy, unnecessary taxes

I took a deep breath when I read in last week’s papers on Kenya Revenue Authority’s (KRA) plans to implement the new presumptive tax to Small and Medium-sized Enterprise (SMEs). This is in the quest to nab more informal businesses in the tax net. SMEs will be required to pay an amount equivalent to 15 per cent of the business permit or trading fee paid to county governments to the taxman.

The presumptive tax adds to an already bulging list of challenges facing SMEs in their quest to survive. From lack of affordable finance, lack of skills, weak corporate governance, lack of opportunities to lack of market opportunities for their products, SMEs finds themselves stuck between a rock and a hard place.

It is, therefore, no wonder that there are 500,000 SMEs dying annually in Kenya and only 30% of them seeing the light of day by their 3rd year of operation. Sadly, only a few reach their fifth birthday.

The presumptive tax is a big setback to the many Kenyans planning to join in the entrepreneurship bandwagon. According to a recent survey by Trends and Insights for Africa (Tifa), 44 per cent of Kenyans plans to set up their own businesses as part of their resolutions for 2019.

The action by KRA/government is contradictory since President Uhuru Kenyatta during an SME conference held at Strathmore in October last year promised to come up with measures to help SMEs flourish. The president at the time acknowledged that the government despite their impact in the economy neglects SMEs. SMEs constitute 98% of all businesses, create about 90% of all new jobs and contributes to 45% of the Country’s GDP.

Even after drafting new 2019 resolutions, the future of small Kenyan businesses and more sensitively the youth looks bleak. The support towards their development has continued to lack and the odds of success not in their favour.

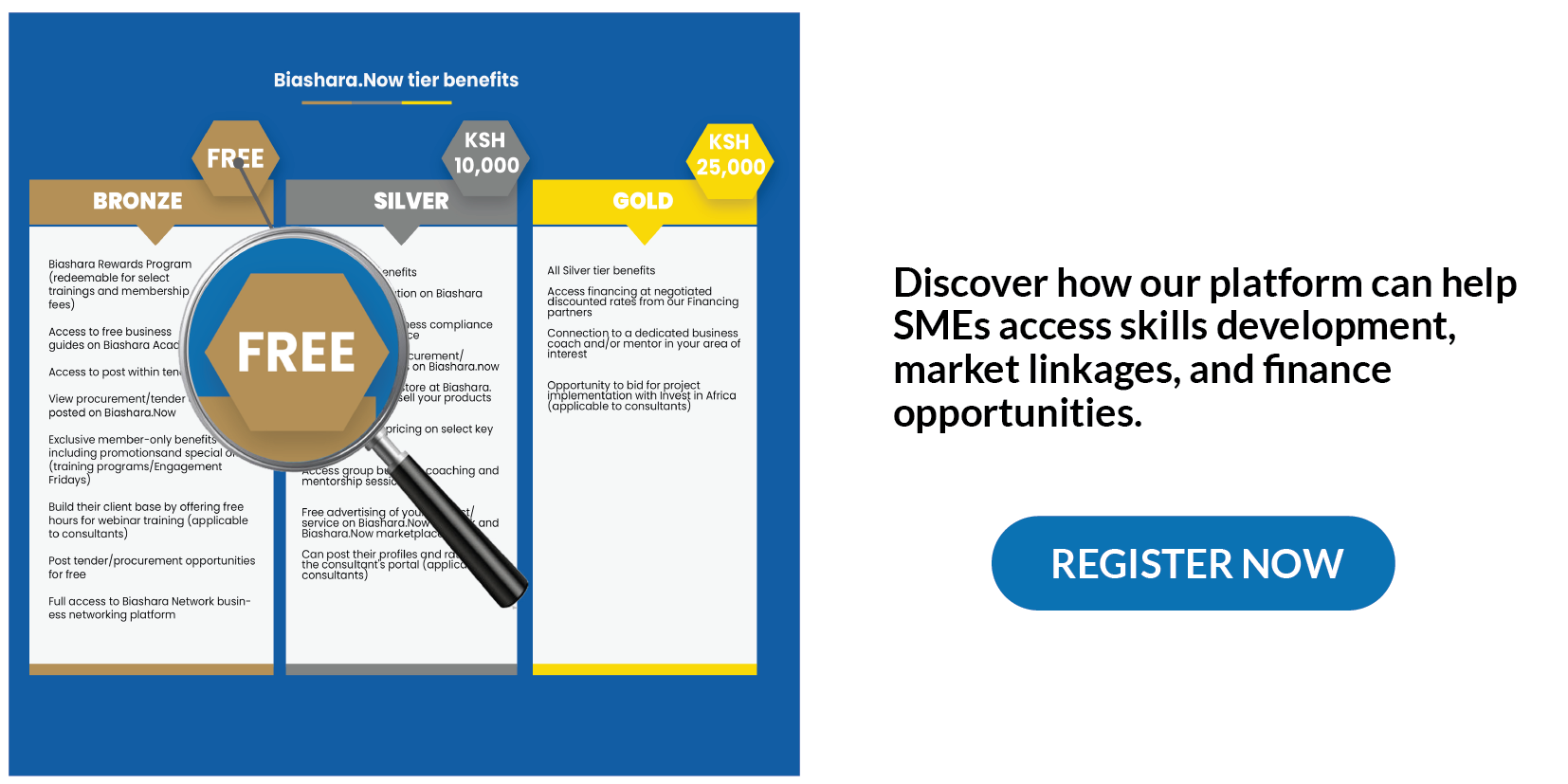

All in all, the private sector finds itself as the sole messiah towards entrepreneurship development. This is because most of the initiatives targeting small businesses and disadvantaged groups are pioneered by NGOs and other private entities. For example, Invest In Africa-Kenya, a not for profit organization has initiated a Credit Guarantee Scheme (CGS) that seeks to provide affordable credit to SMEs in Turkana County. The scheme through an online platform also connects the SMEs to buyers hence creating a sustainable business ecosystem that thrives.

If the Big 4 Agenda is to be implemented, proper thought needs to be put on how to address the SME sector in the economy. When well supported, SMEs can be able to thrive and in turn be able to pay revenue that the KRA desperately needs.

If we continue to do the opposite, ie, stifling the SMEs of opportunities and support while at the same time expecting them to pay hefty taxes, the script will remain the same. SMEs will continue to fail and the rates of unemployment and crime will steadily increase.

The government and other key stakeholders should realize that a vibrant SME sector is a vital ingredient for a healthy economy.

The writer is a communications consultant based in Nairobi