Entrepreneurs Urged to Invest in Business Continuity

Most entrepreneurs have not prepared a succession plan for their businesses in case of their departure. This is why many Small and Medium Enterprises (SME) businesses collapse with the demise or the absence of the business owner. In most cases, it is the owner who carries the vision of the business and ensures that the business remains afloat.

Additionally, most SME’s do not have comprehensive risk and asset management solutions, which leave them greatly exposed to manageable risks and therefore stand a very slim chance of recovering their business in case of an event.

Invest In Africa-Kenya and Liberty Life Insurance, therefore, hosted over 60 SMEs to a business conversation breakfast at a city hotel to discuss business sustainability beyond the owner under the theme: Beyond the Business: Is there tomorrow for your company?

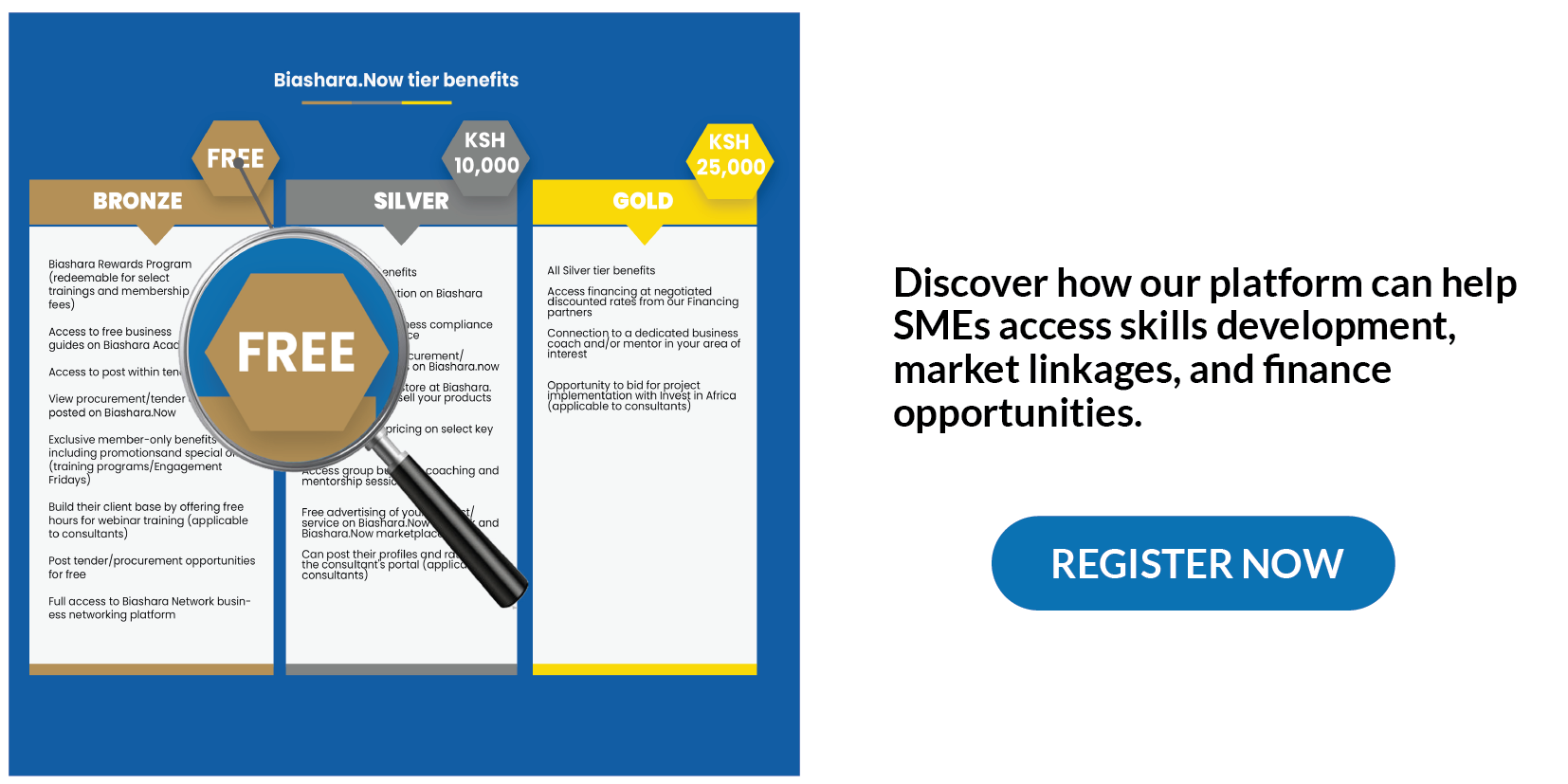

Speaking at the event, IIA Country Manager, Wangechi Muriuki said, "With so many SMEs dying annually, business continuity is at the top of the mind of most SMEs. We are therefore working to support linkages to finance, markets and skills opportunities.”

The event involved a speed networking session and a panel discussion on creating thriving businesses through risk mitigation and succession planning. During the event, Invest in Africa-Kenya released a report of a survey it had conducted among SMEs on their Biashara.Now platform regarding business continuity and cybersecurity threats.

While releasing the findings, Ms Wangechi Muriuki highlighted that about 60% of the respondents mostly feared for their business continuity while 22% were concerned about staff retention. Other factors identified by SMEs included meeting statutory requirements by government and political instability and market demand and unfair competition. Moreover, 36% of SMEs did not have a back-up plan in place in case their company was hacked.

The panel comprised of legal, insurance, data security and financial experts and an SME who dissected the matters arising from the study and offer solutions on how SMEs can ensure business continuity after the owner's demise. They also addressed how to retain and motivate staff, how to protect their businesses from cyber attacks and how to leverage on insurance to protect their businesses.

In the world today where digital adoption has been skyrocketing, SMEs were urged to embrace data security measures to protect themselves from cyber threats. According to a study by cybersecurity firm Serianu, Kenya lost Sh29.5 billion through cyber attacks in 2018. The most targeted including financial services, government institutions, betting and fintech firms. This is through staff training, conducting penetration testers and creating an incidence response plan.

Speaking at the event, Patricia Jepkoech, Safaricom Manager, Cyber Security Incident Response and Management highlighted that many SMEs think that their information is not that important and hence no hacker would be interested. However, in an era where customer data is a new form of business currency, a business can be brought to its knees due to information leakage.

Furthermore, SME owners were urged to develop a succession plan for their business. This involves writing and updating a will, investing in staff training and retention. In order to retain staff, the business must create initiatives and incentives that attract and retain the best staff. This is not only through salaries but also through training, offering pension and insurance plans and much more.

Finally, SMEs should capitalize on available insurance packages that cushion both the business and the employees. Speaking at the event, Liberty Life Kenya Managing Director Abel Munda said’ Our work has been at the heart of SME development, offering a wide variety of long term insurance solutions. We are happy to partner with Invest In Africa to develop solutions for SMEs who are the bedrock of the economy.”